tax on unrealized gains canada

The IRS will process your order for forms and publications as soon as possible. For details on Form 8949 see Reporting Capital Gains and Losses in.

Spouse or common-law partner and taxed in their hands.

. Ordering tax forms instructions and publications. There is a difference between realized and unrealized capital gains. A gain is not realized until the stock or another asset has been sold.

Go to IRSgovOrderForms to order current forms instructions and publications. Unrealized capital gains may be rolled over to an eligible beneficiary eg. In detail Expanding the Net Investment Income Tax NIIT The bill would subject individuals with taxable income in excess of 400000 500000 in the case of a joint return to the 38 NIIT on all net income or net gain from a trade or business regardless of whether the person participates in the trade or business that generated the income unless the income is subject to.

Related

Call 800-829-3676 to order prior-year forms and instructions. The investor needs to keep track of transaction costs capital gains and losses in order to determine their income-tax liability at tax time.

Taxation Of Capital Gains In Developing Countries In Imf Staff Papers Volume 1968 Issue 002 1968

Capital Gains Taxes And The Democrats Downsizing The Federal Government

Taxation Of Capital Gains In Developing Countries In Imf Staff Papers Volume 1968 Issue 002 1968

Reporting Capital Gains Dividend Income Is Complex Morningstar

Taxation Of Capital Gains In Developing Countries In Imf Staff Papers Volume 1968 Issue 002 1968

Capital Gains Harvesting In A Personal Taxable Account Physician Finance Canada

Capital Gains Harvesting In A Personal Taxable Account Physician Finance Canada

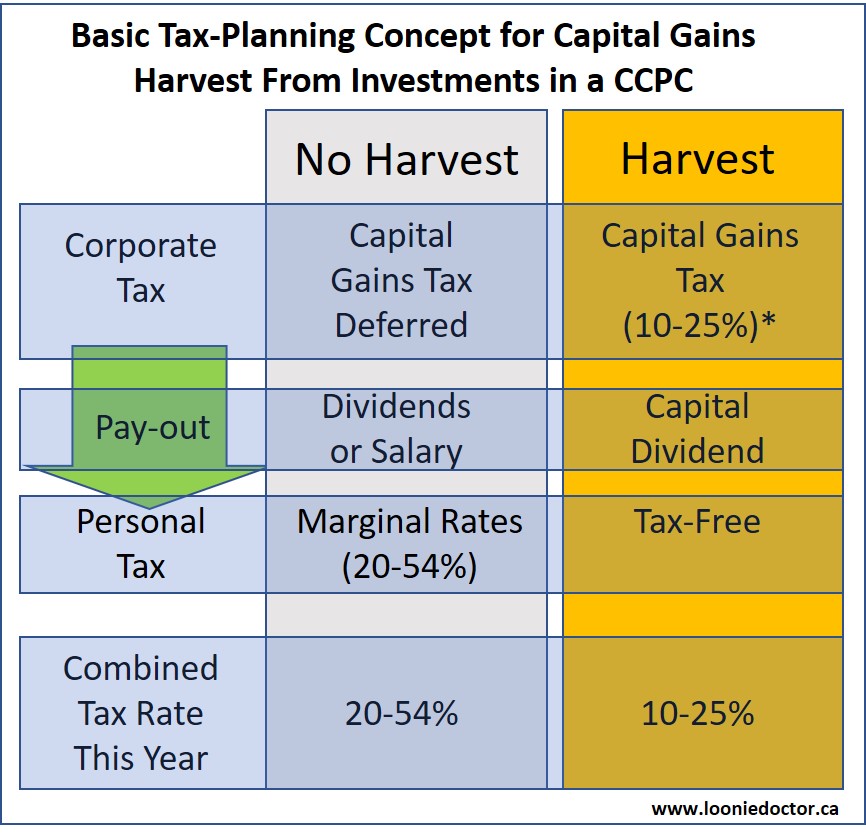

Time For Capital Gains Harvesting From Your Corporation Physician Finance Canada

Evidence On Behavioural Effects Of Higher Capital Gains Taxes In Canada Finances Of The Nation